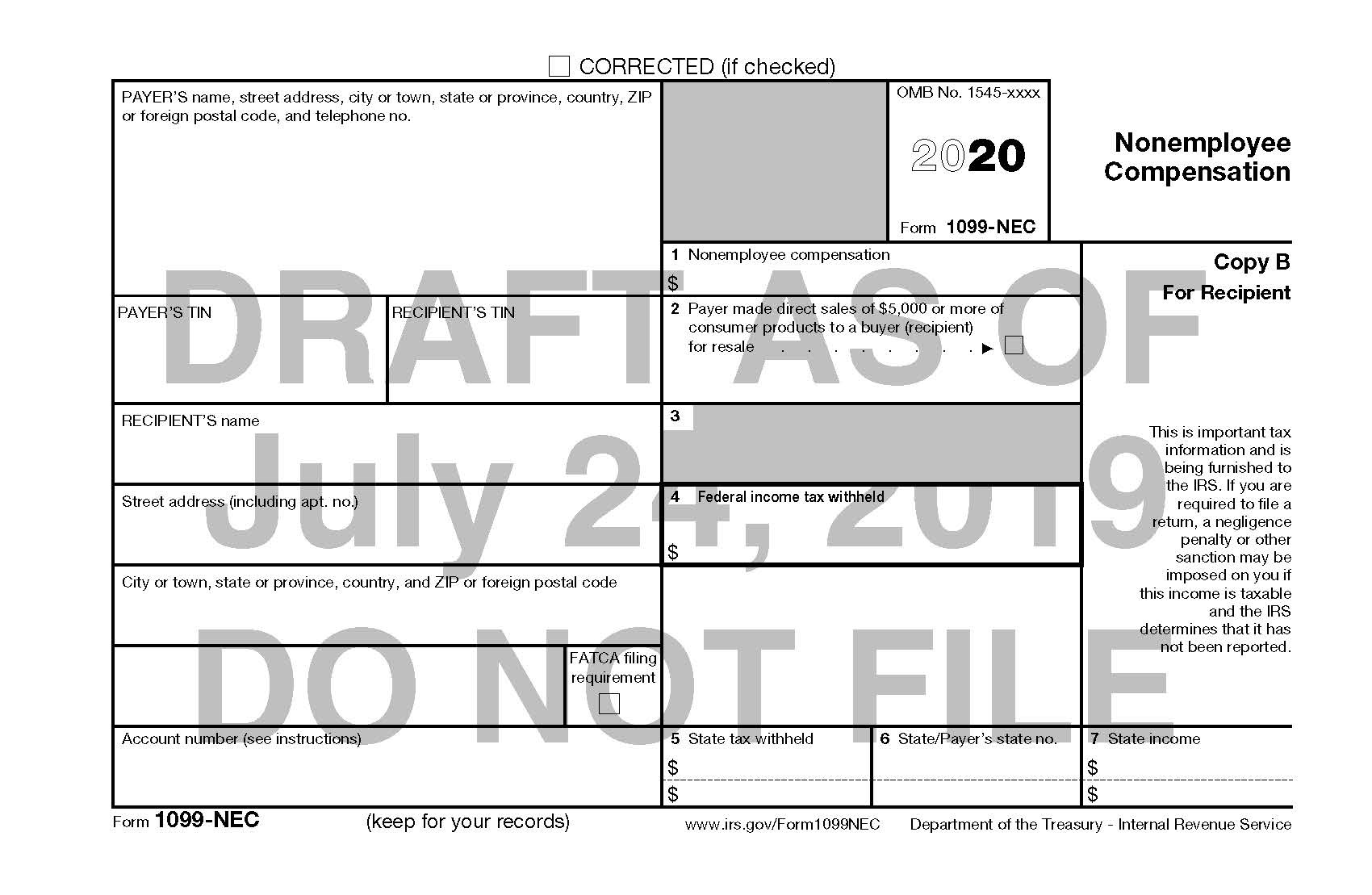

If any boxes are gray, they are mapped to the other 1099 form. Then, let's map the accounts into the non-employee compensation box in the 1099-NEC in QuickBooks Desktop for Mac. We can also re-sort your chart of accounts to fix the odd behavior and makes your lists go back to their default order.

1099 wizard in quickbooks 2020 how to#

For more details, check out Step 4: Move the payments to the new account outlined in the How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing article. Then, create a journal entry to move amounts to show in the newly created 1099-NEC accounts or you can edit existing payments to the new accounts. Then, follow the same process for each new account to report on the 1099-NEC. Enter the Account Name and details such as Description, Note, and Tax-line Mapping.

0 kommentar(er)

0 kommentar(er)